Languages

Contact

CONTACT - 0049 9133 7770-800

Dominik Brokelmann, CEO

When we talk about e-commerce, we shouldn’t only mean e-commerce pureplayers such as, for example, Amazon. Whilst it is true that Amazon is far and away the largest e-commerce retailer in the world and as such the benchmark against which all other companies must be measured, mail order companies, brick and mortar retailers and manufacturers do themselves sometimes make a significant contribution to the turnover generated by e-commerce.

Accordingly, within the framework of our Connected Store concept we were interested to see how shares in turnover generated by e-commerce are distributed according to business model and type of retailer and how market researchers expect the trend to go.

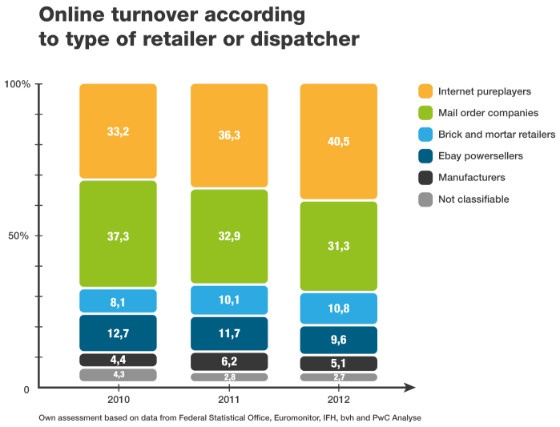

It is unfortunately very difficult to obtain watertight figures in this respect, and there are at times considerable discrepancies. In the graph below, I have consolidated the figures available from the BVH (German E-Commerce and Distance Selling Trade Association) and the IFH (Institute for Retail Research), taking an average to give an idea of how figures looked between 2010 and 2012.

MARKET SHARES IN E-COMMERCE

Pureplayers (purely online shops) are responsible for approximately 40% of e-commerce and gained considerably in strength between 2010 and 2012. The second largest group consists of traditional catalogue mail order companies, whose market share fell by roughly the same proportion.

As the overall volume is growing, this entails a relative loss, with the individual companies generating an absolute growth in sales. Whilst the share in e-commerce accounted for by brick and mortar retailers grew slightly and they were able to defend their market share, they had not yet participated in e-commerce in 2012 to the extent we expect in future. It is also interesting that eBay power sellers shrunk relatively compared to the overall volume. We believe that this is due to the fact that the eBay platform has already been established for a long time, and simply does not have additional growth potential of this scale available.

A particularly interesting factor is the market share accounted for by manufacturers selling directly via the internet to end customers. Depending on which source you take, their share in the entire e-commerce business lies between 2.5 and 10%. There is a large degree of uncertainty about these figures, as they are not communicated publically by the manufacturers.

Market researchers differ greatly in their assessment of which retail concepts are set to benefit most from e-commerce in future. All experts agree, however, that brick and mortar retailers will have to devote a great deal of effort to catch up with the pureplayers.

DEVELOPMENT OF PUREPLAYERS

We at Brodos are very interested to see which retail type will be particularly successful in the e-commerce sector in the long term. Our assessment is that pureplayers will continue to enjoy greater growth than brick and mortar retailers for quite some time. This is due to the fact that as well as offering end customers prices which are often better, they can also use their headstart in processes, logistics, technology, procurement processes, reaching customers and handling search machines to offer e-commerce customers a better and more stable purchasing experience.

We will see how long the e-commerce pureplayers will continue to keep and use these pioneer benefits. In the medium-term, however, the tables are set to turn. E-commerce experts are moving each day to brick and mortar retailers in order to build up their e-commerce business, taking with them the relevant expert knowledge, contacts to the internet industry and the processes needed in order to be able to compete on an equal footing with the pureplayers. Brick and mortar retailers can offer customers considerably more service in store, and will combine this with their offers available online. This will lead to pureplayers suddenly finding themselves at a disadvantage, with consumers choosing to buy online, but from a retailer who runs a local store as well. The only way pureplayers can compensate for this disadvantage is with their prices, generating less margin.

Furthermore, the regional presence of brick and mortar retailers is in itself advertising for the online business and it is very probable that customers will specifically go to the online shop offered by regional retailers, preferring to make a local purchase if prices are comparable. This could lead to regional online retailers having to invest less money in search engine advertising than e-commerce pureplayers.

MANUFACTURERS’ ONLINE BUSINESS

As well as brick and mortar retailers, it will be also interesting to see how the manufacturers’ online business will develop. We believe that in future manufacturers will become considerably braver, selling a larger share of their products to customers directly online, skipping the retail channel entirely.

In our opinion, this is inevitable. After all, manufacturers have to position their products on the internet anyway, taking care to place them in the right light and target consumers’ emotions. They have to invest a lot of money in this, and it is highly unlikely that we will find any manufacturers who fail to offer an internet presence of this nature in future. End customers expect to be able to find the relevant information on all products online. Once the customer has gone to a manufacturer’s website and has decided to purchase one of their products, the manufacturer will try to complete the purchase without risking that customers change their mind entirely whilst searching for a suitable stockist. Dispatching goods to end customers is not an service which is unique to internet shops and I believe that competition will be so intense in future that manufacturers will themselves want to manage the dispatch of the goods and accordingly the experience end customers have when they receive the goods.

This would even have two practical side effects for the manufacturer. Firstly, they can earn more from the sale, retaining the entire sales margin themselves, and secondly, by being the dominant seller on the internet, they can regulate the pricing of their products on the internet much better.